INTERVIEW OF THE MONTH

INTERVIEW WITH MR. SUDHIR DASAMANTHARAO,

Director & Head – Global Business Services APAC – Boston Scientific

How do you see the shared service organization of the future look like? What factors will contribute to its changes?

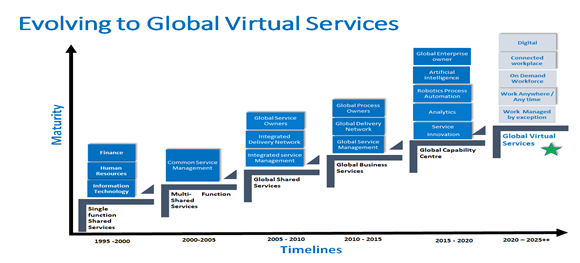

The future of Shared services is going to evolve into virtual services as a result of the ongoing COVID situation. Many external forces are pushing us towards new business models which in turn is leading to many internal changes. As we know business models are evolving into data-driven predictive models and every organization is therefore turning into IoT.

There are some companies that are redefining an existing industry, some are creating new industries while others capturing an entirely different industry. These changes in the business models of parent organizations are driving internal changes.

Global Shared Services organizations continue to embrace the external pressure for new business models which in turn lead to internal changes with transformation in three critical areas – process, people, and technology.

Factors that contribute to change are:

(Process) Future of Work: Transactional processes are automated / robotized / eliminated /digitized, which means the current transactional work will be completely transformed, work will be managed by exception.

(People) Future of Workforce: Workforce will be more on-demand, which means concepts like gig workforce, bot workforce, temp workforce will become the dominant part of the workforce. This will also enable boundaryless hiring.

(Technology) Future of Workplace: Workplace will be connected, enabling collaboration through digital means, people would be able to work from anywhere and anytime, driving virtual connections and conversations.

What are some of the transforming trends in the finance function within large enterprises? In what ways are these contributing to better company performance?

The Finance function is one area where there is a large focus on transformation. Let me divide the finance function into three broad areas and then explain the transformation efforts that are happening in each area.

- Accounting & Controls

- Finance Planning & Analysis (FP&A)

- Tax and Statutory compliance

Accounting & Controls: In the accounting and controls process, the majority of P2P (Procure to Pay) processes are digitized by implementing new platforms like ARIBA. In ATR (Account to Report) process most of the MJE (Manual Journal Entries) are processed by bots which are 80%-90% automated. Very few JEs are processed manually. Reconciliations are also automated. There is a large focus on end-to-end process standardization and optimization across the accounting & controls processes. Tools such as Cadency are used in the ATR process.

In CTC (Customer to Cash) process 90% of the order processing is automated and receivables are accounted for automatically with very minimal intervention.

Finance Planning & Analysis (FP&A): In the FP&A process the entire budgeting and reporting process is automated through Tableau, which is helpful for business teams to access reports in real-time. Through mobile apps, the leadership and sales team can access the DSR (Daily Sales Reports) anytime. Most of the data extraction for reporting is done by Bots which saves a lot of time for the reporting team.

Tax and Statutory Compliance: In Tax and statutory compliance, there has been heavy automation through RPA, for tracking and submitting data in government portals (GST).

Tracking and providing alerts for all compliance due dates to respective owners have been automated completely.

Given that there is a large transformation happening in the finance space where most of the transactional work is automated now, the finance teams now have time to focus on business partnerships and process reviews. For this kind of new focus, finance teams need to upskill themselves. They need to learn how to operate in the digital finance space.

Do you believe there will be a significant skill gap in the future as a result of such transformations? What if any, will be the kind of skill gaps?

There are certain areas in which we see a significant skill gap due to these transformations. I segment these skills into four buckets:

- Functional Expertise

- Business Partnering & Insights

- People Leadership Skills

- Enabling Skills

Functional Expertise: Include planning skills, analytical skills, accounting & internal control skills and financial system excellence.

Business Partnering & Insights: Include strategic thinking, business acumen, decision support and business partnering.

People Leadership Skills: Include collaboration, relationship building, people development and virtual leadership.

Enabling Skills: Include communication, execution, project management and change management.

What are some of the good practices for designing and deploying an RPA? What are some of the key business benefits of an RPA?

Best practices in building a robust RPA strategy and execution include the following elements.

- Leadership Sponsorship: This is very critical to have support from top leadership, show the ROI through small POCs, and make them successful.

- Governance: Create central governance to share the success stories of RPA deployments

- RPA COE: Have one centralized team of RPA Center of Excellence, which is critical for success.

- Robust Change Management: Identify the right process and engage people in deploying the RPA bots, train the process owners in deploying bots and eventually make them the change champions in further scaling of bots.

- Partnership with IT team: Partnership with the IT team is very critical in making RPA successful, right from choosing the right RPA partner for the organization.

Once you get this right you will see tremendous demand for scaling up RPA in the organization which will deliver huge savings. As you scale up, it is important to mature from simple RPA to RCA (Robotic Cognitive Automation), Intelligent Automation, AI, ML, etc.…

The term digital transformation has different connotations for different enterprises. What is your view of digital transformation? Do you believe that the term ‘digital’ itself has evolved in the past few years, and if so how?

In my view the definition of digital transformation is the integration of digital technology into all areas of a business, fundamentally changing how we operate and delivering value to the business.

It is also a cultural change that requires organizations to continually challenge the status quo, experiment, and get comfortable with failure.

Certainly, the term digital and understanding about digital transformation has been very inconsistent across various people and leadership. There is a lack of understanding between the words Digital Vs. Digitalization. There is also a huge skill gap in delivering digital transformation. It is like saying every automation is not digital transformation whereas every digital transformation might be considered as automation.